The market is quietly changing

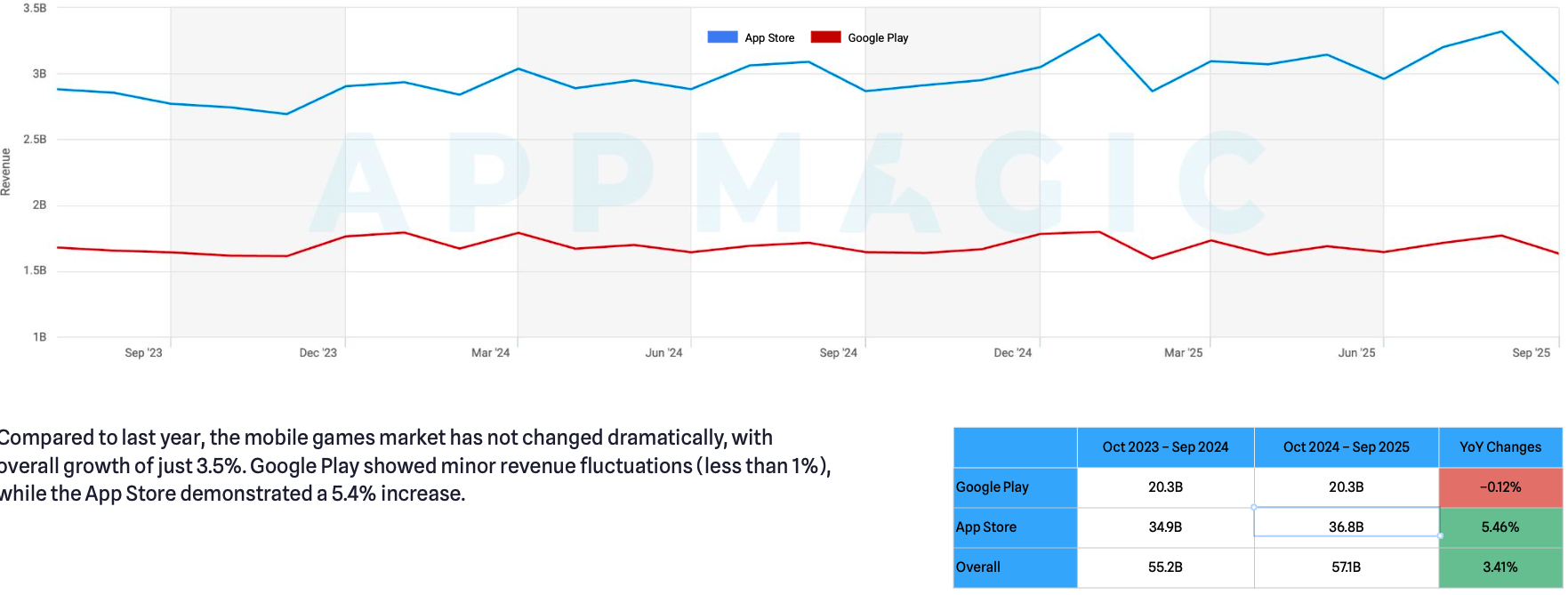

At a glance, mobile game monetization in 2025 looks… stable.

Global IAP revenue grew about 3–4% year over year. That's just enough growth to make the market feel alive but not enough to hide what’s really happening underneath.

And that’s the key theme of this report:

The market is steadily concentrating.

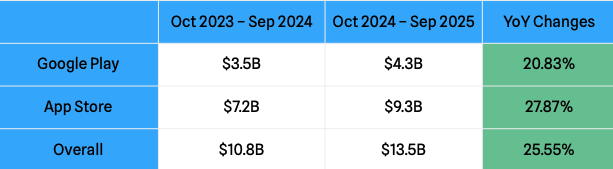

Growth still exists but it requires extra examination

Overall growth is being carried by a small set of genres and regions rather the market as a whole.

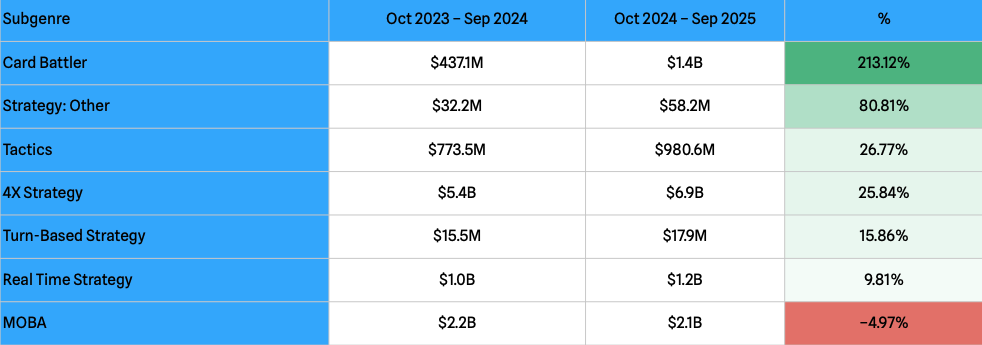

On the genre side:

- Strategy, Simulation, and Hybridcasual are doing the heavy lifting

- Most other categories are flat or slowly declining

- Revenue is increasingly dominated by a few breakout titles inside each genre

Essentially, growth is no longer “broad.”

If your game isn’t positioned inside one of the growing sub-pockets (or doesn’t clearly differentiate within its genre), you’re swimming against the wave.

AppMagic, Monetization Report 2025. Global IAP revenue trends by platform, Oct 2023–Sep 2025. Data recorded October 22, 2025.

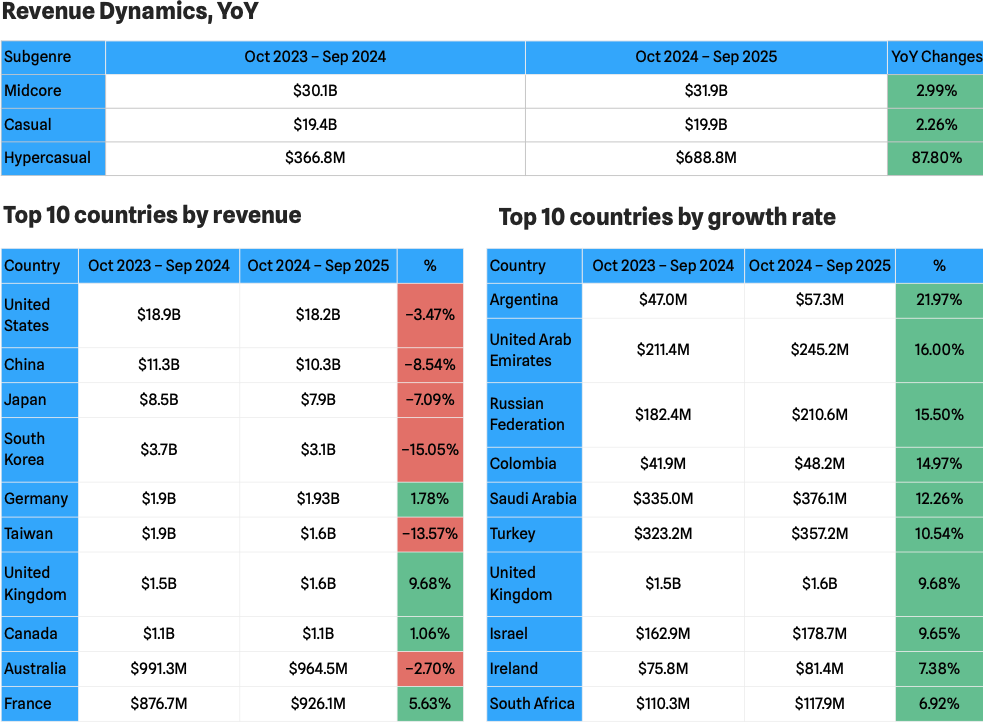

Geography matters more than ever (and not how it used to)

For years, monetization strategy revolved around the same familiar pillars:

US, Western Europe, Japan.

Those markets still generate the most revenue.

But they are no longer where growth comes from.

The report shows clear momentum shifting toward:

- LATAM

- MENA

- Eastern Europe

Countries like Argentina, Colombia, Saudi Arabia, Turkey, and the UAE are showing double-digit growth, largely driven by expanding player bases and improving monetization depth despite having volatile currencies.

Meanwhile:

- The US, China, Japan, and South Korea are flat or declining

- ARPPU remains high, but player spending growth is slowing

What this means:

The market is no longer just about extracting more value from the same players.

It’s about learning how different regions spend, churn, and respond to offers.

A one-size-fits-all monetization strategy underperforms now more than ever.

AppMagic, Monetization Report 2025. Country-level IAP revenue growth rates, Oct 2023–Sep 2025.

AppMagic, Monetization Report 2025. Country-level IAP revenue growth rates, Oct 2023–Sep 2025.

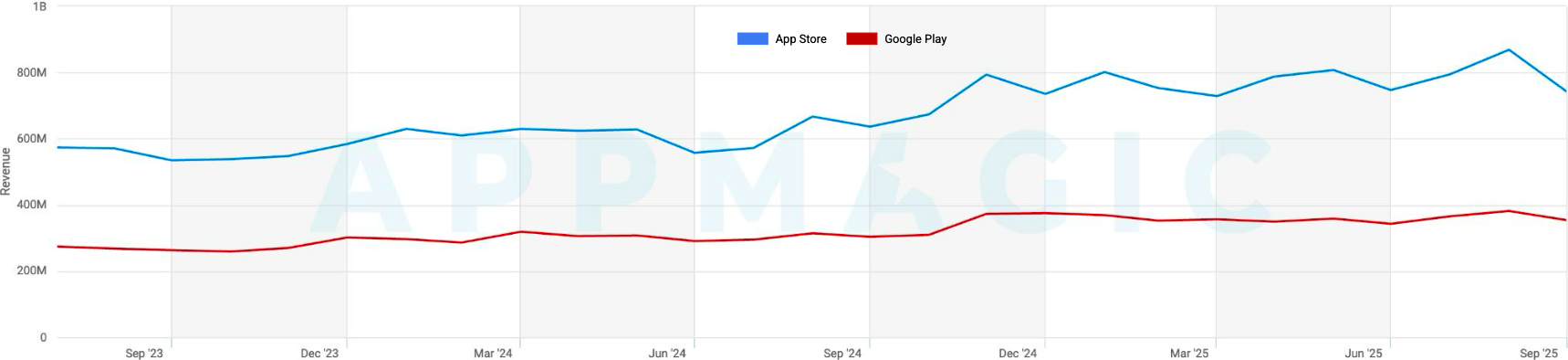

Platforms are telling two very different stories

One of the quiet but important shifts in this report is the growing divergence between App Store and Google Play.

- App Store revenue is growing faster

- ARPPU is higher across most genres

- Fewer purchases, but larger average payments

On Google Play:

- Purchase frequency is higher

- Average transaction size is flat

- Growth is harder to unlock without scale

This isn’t just a platform preference issue.

It’s a player behavior issue.

iOS players are increasingly conditioned for:

- Premium bundles

- Higher first-purchase thresholds

- Bigger “anchor” prices

Android players respond better to:

- Frequency

- Lower price points

- Long-tail monetization

If you’re copying pricing or offer design across platforms, you’re optimizing for neither.

AppMagic, Monetization Report 2025. Platform-level monetization dynamics and ARPPU trends.

AppMagic, Monetization Report 2025. Platform-level monetization dynamics and ARPPU trends.

Simpler games are winning, but not for the reason you think

Another major pattern: simple and hybrid formats are expanding fast, especially inside Puzzle, Simulation, and Hybridcasual genres.

What this means:

- Lower cognitive load → higher conversion

- Faster onboarding → more monetizable users

- Hybrid systems → flexibility to scale spend later

The winning formula is simple first, deeper later.

Games that understand when players are ready for complexity are outperforming games that front-load it.

Revenue is concentrating at the top

Here is one of the most important signals in the report:

Over 40% of revenue in each genre comes from the top five titles.

This concentration is increasing, not decreasing. In mature markets, concentration of revenue at the top isn't a particularly new phenomenon.

However, it tells us two things in this context:

1. The market is rewarding clarity and execution, not experimentation

2. Marginal improvements in monetization design now separate winners from everyone else

In a concentrated market, guessing wrong is generally more expensive.

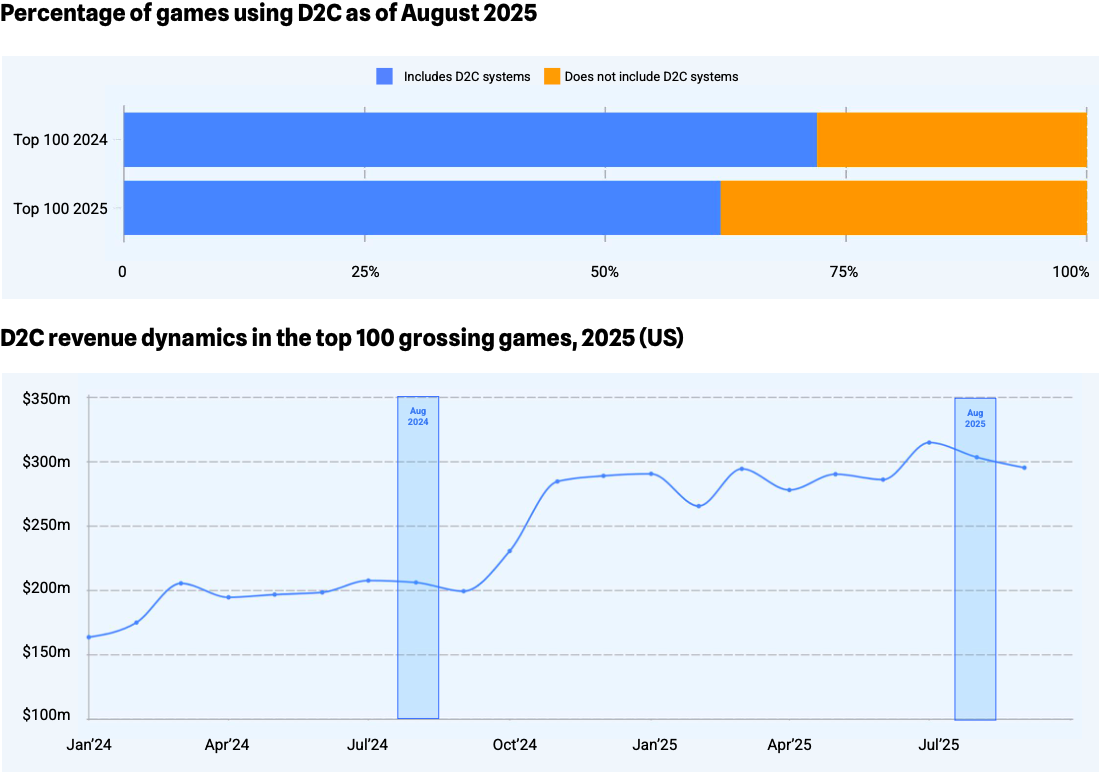

More studios are implementing direct payments

Alternative payment systems and D2C monetization grew 46% year over year, but adoption is still uneven.

- Only ~62% of top-grossing games use them

- Older, established titles benefit most

- Newer games are slower to integrate

This signals maturity.

Studios don't have the luxury to experiment blindly anymore.

They’re integrating D2C only when it clearly supports long-term revenue and player trust.

So… who’s actually making the money?

Here’s the simplest way to put it:

A few games are taking a very big slice of the pie. Everyone else is sharing what’s left.

In most genres, the top five games alone make over 40% of the total revenue. And that share is getting bigger, not smaller.

Imagine a pizza party:

- Five people take almost half the pizza

- Everyone else is splitting the rest

- The pizza isn’t getting much bigger each year

That’s today’s mobile gaming market.

This doesn’t mean new games can’t win, it's just that small mistakes hurt more than they used to.

When revenue is spread out, you can afford to guess.

When revenue is concentrated, guessing is expensive.

The teams at the top are winning because understand their players slightly better. That difference compounds over time since each decision is backed by insightful data.

Why “more data” isn’t the answer anymore

At this point, most studios already have the data.

You can see:

- Revenue going up or down

- Retention curves

- Conversion rates

- Store reviews

- Social comments

So the problem is not a lack of information at all. The problem is that by the time numbers move, it’s already late.

The numbers take too long to accurately reflect how players feel:

- Confused after an update

- Frustrated by a balance change

- Excited by a new feature

- Turned off by a price increase

Those feelings show up in words long before they show up in charts.

But most teams don’t have a clean way to separate:

- Real warnings vs loud complaints

- Short-term anger vs long-term risk

- What matters now vs what can wait

So decisions get delayed, watered down, or made on instinct.

In a market where most of the money flows to a few winners, understanding players early is the advantage.

Its crucial to know what players actually care about, and why. Even better if that can be done earlier than everyone else. That’s the difference between staying in the game and quietly slipping out of it.

The next era of game marketing will be defined by who understands the landscape best.

Get Early Access to GameRebellion

We’re opening Early Access registration for studios ready to start using our new Player Sentiment Analysis Tool.

👉 Register now at gamerebellion.com

👉 We’re also looking for early testers.

If you want hands-on access and the chance to directly shape the tool’s development, reach out at:

(Please include “I want to use the sentiment tool” in your subject line.)

Be among the first studios shaping the future of game intelligence!